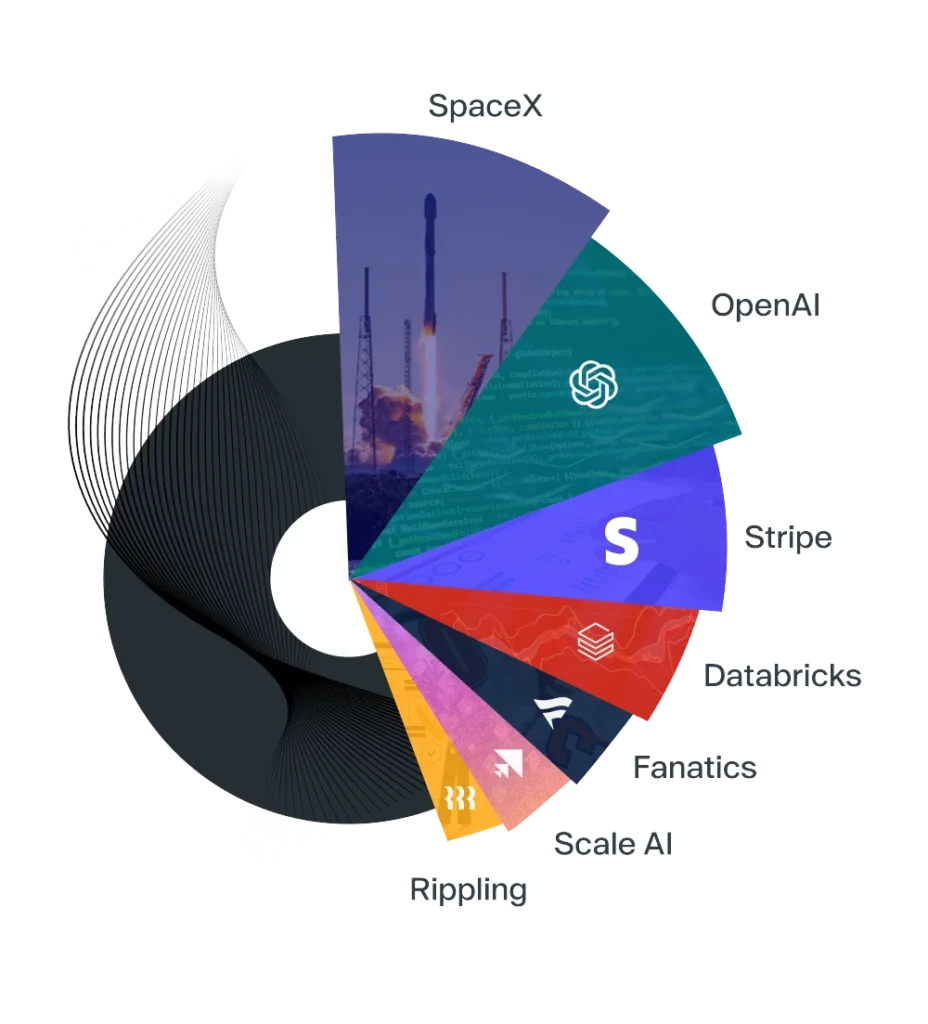

Seven companies that led the private market through the Great Reset: SpaceX, Stripe, OpenAI, Scale AI, Databricks, Rippling and Fanatics.

Magnificent 7 – Public vs. Private Performance

The Private Magnificent 7 represent a group of private, venture-backed, late-stage companies that have demonstrated resilience throughout the Great Reset and propped up the performance of the Private Market over the recent market cycle, much like their public market counterparts.

Performance of Hypothetical $10,000

+146.7%+37.0% ———– Sep ’23 $10,000 ——— May ’25 $27,500

Inception: 8/31/23

Compare to:

Private Magnificent 7

Public Magnificent 7

QQQ

| Returns | 3M | YTD | 1Y |

| Private Magnificent 7 | 33.1% | 10.0% | 78.2% |

| Public Magnificent 7 | -14.8% | -13.7% | 16.9% |

*Private Magnificent 7 data from Forge Data

Public Magnificent 7 data from NASDAQ

The Private Magnificent 7 represents a wide cross-section of industries, with subsectors ranging from Data Intelligence to Payments to HR and more.

- SpaceX

- OpenAI

- Stripe

- Databricks

- Fanatics

- Scale AI

- Rippling

Both the public and private Magnificent 7 represent almost a quarter of their respective markets.

Key Takeaways

- The Private Magnificent 7—SpaceX, Stripe, OpenAI, Scale AI, Databricks, Rippling and Fanatics—represent 34% of US unicorn valuations and comprises the most funded and best performing companies in the space. 28

- Similar to the public markets, the private markets have select heavy weights that represent a disproportionate share of the market value.

- These large players can have an outsized impact on the performance of the overall private market, as seen through the Forge Private Market Index (“FPMI”) and the Forge Accuidity Private Market Index (“FAPMI”).

Companies

| Company | Sector | Subsector | Forge Price | Forge Price Valuation | 1-Year Return | 5-Year Return | |

| SpaceX | Industrial | Aerospace & Defense | $229.97 | $435.08B | 109.06% | 940.29% | |

| OpenAI | Enterprise Software | Data Intelligence | $297.76 | $172.70B | 115.88% | ||

| Stripe | FinTech | Payments | $35.95 | $91.50B | 37.38% | 181.81% | |

| Databricks | Enterprise Software | Data Intelligence | $107.91 | $72.38B | 54.16% | 439.55% | |

| Fanatics | Consumer & Lifestyle | Clothing, Fashion, Beauty & Apparel | $42.00 | $17.09B | -20.75% | 196.40% | |

| Scale AI | Enterprise Software | Data Intelligence | $16.61 | $15.76B | 73.93% | 1,040.72% | |

| Rippling | Enterprise Software | Human Resources | $50.62 | $15.53B | 42.62% | 3,352.30% | |

Data updated daily

FAQs

What is the Private Magnificent 7?

The Private Magnificent 7 represent a group of private, venture-backed, late-stage companies that have demonstrated resilience throughout the Great Reset and propped up the performance of the Private Market over the recent market cycle, much like their public market counterparts.

Does the Private Magnificent 7 affect Forge indices?

Most of the Private Magnificent 7 are in the Forge indices. Their price performance will have an impact, but the degree of impact is dependent on the weighting scheme of the index (generally less in the equally weighted index and more in the cap weighted index).

How can you invest in the Private Magnificent 7?

Currently, accredited investors can invest in all or a selective set of the Magnificent 7 companies through the Forge platform, subject to availability.

Qualified Purchasers can invest in The Accuidity Megacorn Fund that seeks to track the Forge Accuidity Private Market Index – which offers low-cost exposure to a broader and more diversified set of private companies. The Index includes 6 of the Magnificent 7 stocks, OpenAI being the outlier.

Why were these companies selected to be included in the Private Magnificent 7?

The methodology for determining the Private Magnificent 7 is based on implied valuation, performance, brand equity, and liquidity.

Why aren’t ByteDance, Epic Games, Shein or other large pre-IPO companies included in this list?

Inclusion in the Private Magnificent 7 depends on multiple factors and the chosen companies were outperformers across most or all categories. Additionally, there are certain companies, like Bytedance and Shein, that are not US-based companies which was a criteria for inclusion.